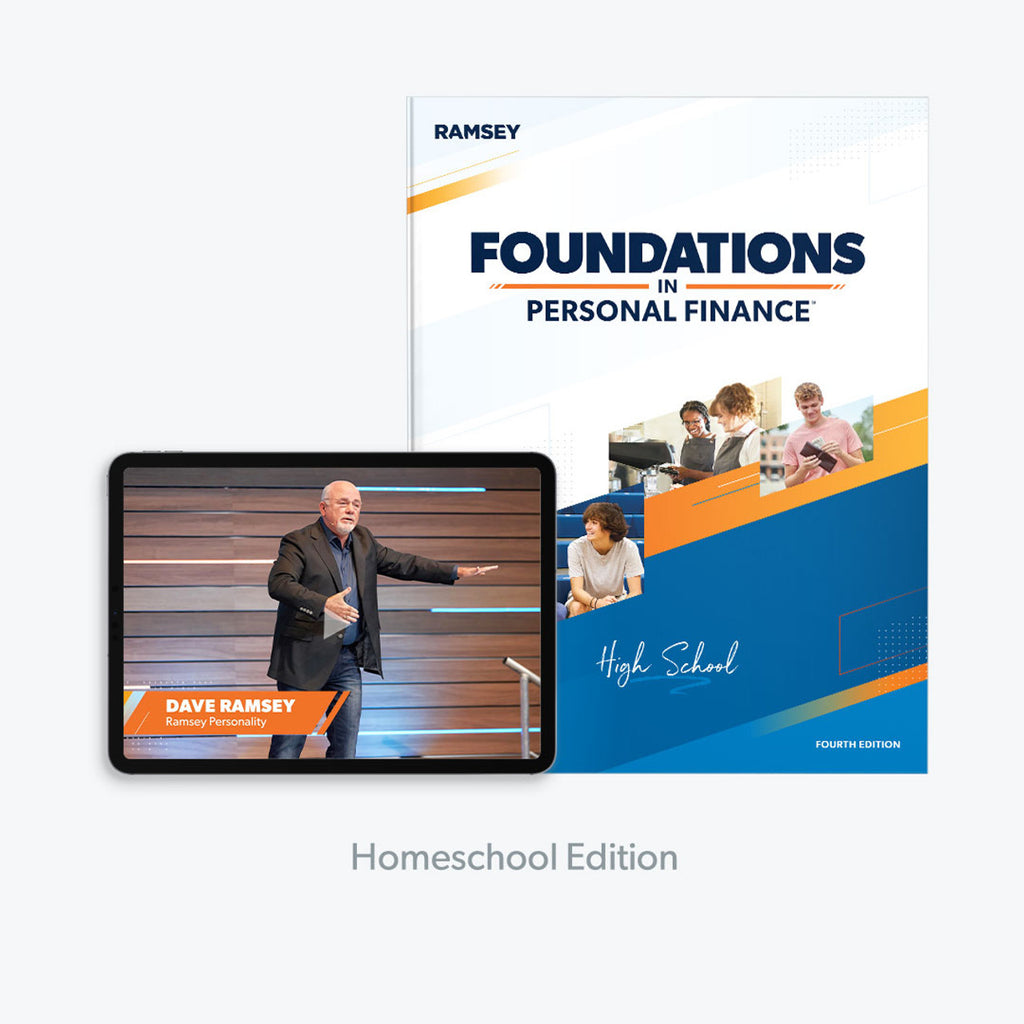

Foundations in Personal Finance: High School for Homeschool Teacher + Student Bundle, 4th Edition

Teaching your teen about personal finance doesn’t have to be complicated. Seriously, you just need a homeschool curriculum that’s got everything prepped for you, in one place, and made with your unique homeschool environment in mind. Well, that’s Foundations in Personal Finance. Your teens will learn the money skills they’ll use now and for the rest of their lives, so they’ll have a solid foundation when they’re out on their own (see where we got the name?)

But it doesn’t just stop there. This course trades boring formulas and financial theories for time-tested principles, real-life applications and humor (yes, personal finance can be fun!). And there’s no personal finance degree required!

Dave Ramsey and our team of experts teach all the content for you—so you don’t have to sweat it. You’ll get everything you need, from lesson guides to engaging video lessons to auto-graded assessments—so you can teach confidently.

This product includes a print textbook with a voucher code for digital access to streaming video lessons for 1-year.

Curriculum Features:

- Parent-led or independent study learning options

- Teacher resources (lesson guides, activities, transcripts and more!)

- 13 stand-alone chapters that can be taught in any order

- Devotionals and a scripture reference guide for additional study on the biblical view of finances

- Easy, secure course access.

Click here to order additional student workbooks.

Copyright 2023, SKU 4483910, ISBN 9781936948642, 4th Edition, Recommended for grades 9-12

NOTE: Due to the unique one-time code, this item is non-returnable.

| Book Title | Foundations in Personal Finance: High School for Homeschool Teacher + Student Bundle, 4th Edition |

| Publisher: | Ramsey Education Solutions | The Lampo Group, Inc. |

| Author | Dave Ramsey |

| ISBN |

Teaching your teen about personal finance doesn’t have to be complicated. Seriously, you just need a homeschool curriculum that’s got everything prepped for you, in one place, and made with your unique homeschool environment in mind. Well, that’s Foundations in Personal Finance. Your teens will learn the money skills they’ll use now and for the rest of their lives, so they’ll have a solid foundation when they’re out on their own (see where we got the name?)

But it doesn’t just stop there. This course trades boring formulas and financial theories for time-tested principles, real-life applications and humor (yes, personal finance can be fun!). And there’s no personal finance degree required!

Dave Ramsey and our team of experts teach all the content for you—so you don’t have to sweat it. You’ll get everything you need, from lesson guides to engaging video lessons to auto-graded assessments—so you can teach confidently.

This product includes a print textbook with a voucher code for digital access to streaming video lessons for 1-year.

Curriculum Features:

- Parent-led or independent study learning options

- Teacher resources (lesson guides, activities, transcripts and more!)

- 13 stand-alone chapters that can be taught in any order

- Devotionals and a scripture reference guide for additional study on the biblical view of finances

- Easy, secure course access.

Click here to order additional student workbooks.

Copyright 2023, SKU 4483910, ISBN 9781936948642, 4th Edition, Recommended for grades 9-12

NOTE: Due to the unique one-time code, this item is non-returnable.